Coverage for life-threatening PED conditions##

Coverage for life-threatening PED conditions##

Asia is home to 49 countries and is the largest continent by size globally. It is the only continent that shares its borders with two more continents, Africa and Europe. Exploring the vast land of Asia is sure to give you the experience of a lifetime.

Care Travel Insurance brings you a plan that gives you the best protection during any medical or non-medical exigency. We offer these benefits under the policy coverage, from immediate cashless hospitalization to reimbursement for lost checked-in baggage, trip delay/cancellation, assistance in case of loss of passport, etc. You can get the policy at an affordable premium to enjoy your trip worry-free.

No, it is not mandatory for all Asian countries. But, given the Covid-19 situation over the past few years, many countries have changed their regulations for the people traveling to their country. However, even in countries where travel insurance is not mandatory, it is wise to purchase one as unexpected emergencies can result in unwanted expenditures and spoil the fun during your international trip.

We've got you covered to make your journey joyous and stress-free regardless of your travel purpose. Summarizing below some of the unique features and benefits of opting for the best travel insurance across Asian Countries-

Affordable Premium: Make your trip secured while availing a travel cover at an affordable premium with us.

Automatic Trip Extension: You can easily extend your travel insurance coverage for up to 365 days or the maximum trip duration.

Compensation in case of Mishaps: The plan offers compensation to the nominee if any unfortunate incident or accidental death occurs.

Complete Protection: By covering non-medical emergencies such as trip delays, loss of checked-in baggage, loss of important travel documents , etc. the policy offers round-the-clock assistance.

Cashless Claim Settlement: It is one of the essential benefits offered under travel insurance for Asian countries.

Care Health Insurance offers comprehensive travel insurance for any of the Asian countries you wish to travel to under Explore Asia. This exclusively designed policy takes care of your emergency travel expenses arising out of an unfortunate event during your trip. Getting travel insurance is a smart option if you are looking for all-in-one coverage. The best part is you can even get it online without any hassle of approaching the agents. It comes with several benefits to help you deal with unexpected medical and non-medical expenses in a foreign land.

|

Description |

Explore Asia |

|---|---|

|

Sum Insured |

US $ 10k, 25K, 50K & 100K (Vary according to the premium) |

|

Trip Options

|

Yes Yes |

|

Entry Age (Single Trip) |

Minimum Maximum |

|

Entry Age (Multi-trip) |

Minimum Maximum |

*Family option is only available on Single Trip Policies. Please refer to the prospectus for more details on eligibility.

We've got you covered to make your journey joyous and stress-free regardless of your travel purpose. Summarizing below the benefits of opting for the best travel insurance for Asian Countries:

Hospitalization Expenses- We cover your expenses in emergency hospitalization due to illness or injuries and treat pre-existing diseases through the health insurance cover in our Asia travel insurance.

Daily Allowance- We reimburse for a specified amount per day for each day of hospitalization as In-patient Care for up to 5 consecutive days per claim.

Personal Accident- We will compensate in the event of the insured person's death or Permanent Total Disablement (PTD) due to accidental injury during the Period of Insurance.

Trip Cancellation & Trip Delay- Such disturbances are beyond your control but with our compensation feature, you can meet any essential expenses arising from the setback.

Loss of Passport & Checked-in Baggage- We may not get you your passport or luggage back, but we sure can cover the loss under this benefit subject to terms and conditions.

Delay of Checked-in Baggage- We will reimburse you for the essentials in case of a delay in receipt of the checked-in baggage beyond 12 consecutive hours.

Compassionate Visit- This feature helps you have your family member by your side during the hospital stay in a foreign nation. Under this feature, the incurred expenses towards the return trip are reimbursed.

Covid-19 Coverage- We will indemnify the expenses incurred due to the hospitalization for covid. There won't be any compensation for quarantining at home, hotel, or any other facility.

Under international travel insurance, you are also eligible for personal liability cover and Repatriation of mortal remains.

*Refer to the policy documents for more detailed information regarding the coverage benefits.

Before purchasing a travel insurance policy, you should review the exclusions given by your insurer:

Drug Misuse: Expenses arising out of or attributable to alcohol or drug use/misuse/abuse by the insured members during the course of the trip.

World War: Any medical or non-medical expenses arising out of national or international war or nuclear perils or consequences thereof.

Self-inflicted Injury: Any intentional self-injury, suicide attempt, or any other form of harm to self leading to hospitalization or demise.

Hazardous Activities: Any claims relating to hazardous activities like fire stunts, etc., that are otherwise not mentioned in the policy documents.

Breach of Law: Any liability or injury expenses arising out of any breach of law or particular regulations set by the destination country.

Dental Treatment: Expenses of any planned dental treatment or surgery unless necessitated due to any acute pain.

Note: Plan features, benefits, coverage, and underwriting of claims are subject to policy terms and conditions. Please refer to the brochure, sales prospectus, and policy documents carefully.

When choosing travel insurance for any Asian location, be sure that the coverage meets your needs. The following are the elements to consider.

Nature of the Trip: Frequent fliers should get yearly policies, while others should purchase single trip insurance.

Vacation Duration: The smaller the premium depending on the number of days spent in any of the Asian countries, the shorter the trip.

Medical History: If you have a serious illness, be sure the insurance covers it.

Examine the Coverage: Pay special attention to the inclusions to determine what is covered by the Policy. The overseas travel insurance plan provides optimum advantages at a low rate.

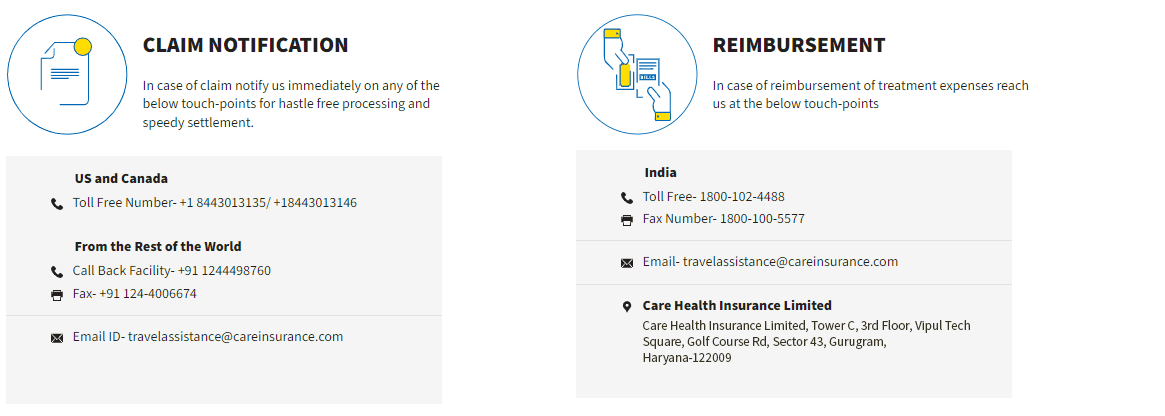

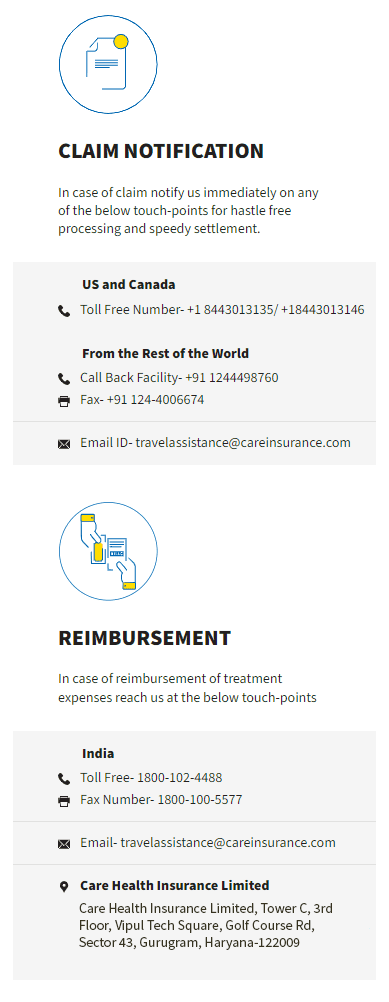

Know the Claims Procedure: Make sure you understand the process for notifying your claim.

Central Asia comprises countries like Uzbekistan, Kazakhstan, Tajikistan, Turkmenistan, Kyrgyzstan, and Afghanistan. To visit this part of the world, make sure you travel light as you could be charged a fee for excess luggage in some places, especially on public transport. The terrain ranges from high mountainous regions to deserts; pack the right clothes depending on the place you are going to. Get set for a unique cultural experience.

The Eastern countries like China, Japan, Mongolia, North Korea, and South Korea are located. Some of the populous regions of the world are found here. For those traveling within budget, there are many affordable destinations to visit in Southeast Asia. Some options you can explore are Malaysia, the Philippines, Thailand, Vietnam, Indonesia, and Singapore. Southeast Asian countries are a hotspot for backpackers, and there are a lot of adventures you can look forward to. When it comes to packing, you will require light cotton clothing as the weather generally remains hot and humid. However, the November to February period is the best time for traveling to Southeast Asia.

South Asia encompasses the Indian subcontinent countries - India, Nepal, Pakistan, Sri Lanka, and Bangladesh. Explore these places that are known for their rich cultural heritage.

Get yourself a comprehensive travel insurance plan at an affordable premium and make your trip fully proof.

The premium for an Asia travel insurance plan is subject to your age, travel country, trip duration, trip frequency, coverage opted, add-on covers, and sum insured.

Cover under Travel Insurance is available on an individual basis and not on a family floater basis.

You are not required to undergo any medical examination for coverage. However, you should declare if you have any pre-existing medical conditions.

The coverage starts from the day you board the conveyance to leave for international travel or the contracted departure date as per the policy, whichever is later.

You will get a soft copy of the travel insurance policy on your registered email id.

The policy can be extended up to a maximum duration of 365 days or maximum trip duration as specified under the plan. The online extension of the travel insurance policy is available.

Disclaimer: The information provided is for reference purposes only. Please refer to the official websites for country-specific information and policy documents for details on plan benefits, coverage, and exclusions.

^^Number of Cashless Healthcare Providers till Feb 2025

**Number of Claims Settled as of 31st March 2024

^Family members on the same policy with the same sum insured receive discounts on the premium of additional members covered: 2 members 5%, 3 members 10%, 4 members 15%, 5 members 17.5%, 6 members 20%.

##The life-threatening pre-existing diseases are covered up to 10% of the sum insured (max. up to $10,000) if disclosed during policy purchase.

Premium calculated for an individual (Age 18), single trip (90 days) in Asia, for sum insured $10,000.

Get the best financial security with Care Health Insurance!

Sales:1800-102-4499

Services: 8860402452

Live Chat