The Importance of Health Insurance for Senior Citizens

Healthcare costs in India are increasing by more than 14% every year. Therefore, the need for adequate health insurance for senior citizens in India has increased after retirement. Know why elderly people must have medical coverage:

- Rising Medical Treatment Costs: Healthcare costs keep rising. But the unexpected medical bills can’t harm you when you are insured.

- Critical Medical Needs: Get access to quality treatment for serious illnesses.

- Day Care Treatments: Insurance plans take everything from doctor visits to short-term hospital stays.

- Burdening Extra Costs: There are no financial worries about miscellaneous expenses like OPD care, pharmacy bills, ambulance charges, etc.

- Vital Health Check-Ups: The ease of getting regular health check-ups without any financial worries.

- Pre-Existing Diseases: We can cover all your pre-existing diseases, subject to the policy's terms and conditions.

Features of Senior Citizen Health Insurance India

Mentioned-below are some of the unique features of senior citizen health insurance offered by Care Health Insurance:

| Plan Offering |

Coverage Details |

| In-Patient Care |

Up to SI |

| Day Care Treatment |

All Day Care Procedures |

| Advance Technology Methods |

Up to SI |

| Pre-Hospitalisation Cover |

60 days before hospitalisation |

| Post-Hospitalisation Cover |

180 days after discharge |

| AYUSH Treatment |

180 days after discharge |

| AYUSH Treatment |

Up to SI |

| Domiciliary Hospitalisation |

Up to SI |

| Organ Donor Cover |

Up to SI |

| Ambulance Cover |

Up to Rs.10,000 per Year for SI < 15 Lacs & Up to SI for SI >= 15 Lacs |

| Cumulative Bonus |

50% of SI per year, max up to 100% of SI |

| Cumulative Bonus Super |

Included for Eldest Member <= 45 years & >=76 yrs; Optional for Eldest Member > 46 years |

| Unlimited Automatic Recharge |

✅ |

| Unlimited E-Consultations |

✅ |

| Health Care Services |

✅ |

Benefits of Mediclaim Policy for Senior Citizens

Our mediclaim for senior citizens benefits elderly people by taking care of all their old-age health worries and gifting them the joy of life. Our medical policy for senior citizens provides vast coverage across network hospitals, treatments, OPD, and COVID centers for helping elder ones lead tension-free retirement years.

Increased health risks brought on by age and changing healthcare needs undeniably highlight the importance of having a senior citizen health insurance scheme.

Affordable Premium

You can rest assured that it is easy to get health coverage for senior citizens at an affordable premium and maximum coverage.

Easy EMI for Premium

Get your health cover today without worrying about current finances through our easy EMI options.

Discounts & Offers

We understand how important our finances post-retirement is, so here we come with numerous discounts such as a multi-year policy, Smart Select, and many more.

Second Opinion

Not sure about your current treatment procedures? Worry not! We get you covered to avail a second opinion from other doctors for a specified illness.

Organ Donor Cover

We respect and encourage the noble cause of donating organs. Our senior citizen insurance covers expenses for organ harvesting operations.

What is Covered Under Senior Citizen Mediclaim Policy?

Medical expenditures are shooting high for elderly people across nations. Opting for medical policy for senior citizen is best to keep unbearable medical expenses at bay. Below is what we covered in it:

Coronavirus Treatment

Senior citizens need not worry about unexpected expenses arising out of coronavirus ailment. We offer complete coverage for COVID-19 treatment costs.

In-Patient Hospitalisation

In times of hospitalization, we are right beside you. We pay for most of the hospitalization expenses, that is, for at least 24 hours.

Pre and Post-Hospitalisation

Health issues in old age increase the frequency of medical visits. Don’t worry! We also cover 30 days before and 60 days after hospitalization expenses.

Annual Health Check-up

We offer annual health check-ups at no additional cost to senior citizens. It helps to keep a better track of your or your elderly parent’s health condition.

Daycare Treatments

Thanks to medical advancement! Now elders can easily avail of over 541+ daycare procedures under our mediclaim for senior citizens.

AYUSH Coverage

Coverage of alternative treatments like AYUSH (Ayurveda, Unani, Sidha, and Homeopathy) makes Care health senior mediclaim the best option for senior citizens.

Domiciliary Hospitalization

We believe in offering the best possible services even at your home. Avail required treatment at home if the patient is unable to move to the hospital. The expenses are covered.

Ambulance Cover

You will get full reimbursement for the expenses incurred for availing of a domestic road ambulance during any medical emergency.

Note: Please always refer to the updated policy T & C, brochure, and prospectus to know more about our health insurance plans for senior citizens cover as they may vary.

What is Not Covered Under Senior Citizen Health Insurance Scheme?

While deciding which mediclaim policies for senior citizens are ideal, you must be aware of what is not covered under your plan, as lesser the exclusions, better it is. Here's a list of exclusions under the best senior citizen health insurance-

- Self-Inflicted Injury: Expenses attributable to self-inflicted injury such as suicide, attempted suicide, etc. are not covered.

- Injuries Due to Consumption of Alcohol: Expenses arising out of or attributable to consumption of a drug or use/misuse/abuse of alcohol/tobacco/gutka or any hallucinating drug are excluded.

- Pregnancy Treatment: Treatment arising from or traceable to pregnancy and childbirth, miscarriage, abortion, and its consequences is not covered.

- Infertility Treatment: Tests and treatments related to infertility and in vitro fertilization cannot be claimed.

- Permanent Exclusions: War, riot, strike, and nuclear weapons-induced hospitalization are considered as permanent exclusions.

- Dental/ Cosmetic Surgery: Most health insurance for senior citizens does not cover the cost for treatment for any dental problems or cosmetic surgeries that are not caused due to an accident.

Eligibility Requirements for Mediclaim Policy for Senior Citizens

At Care, availing of a mediclaim policy for senior citizens above 60 years comes with easy terms and eligibility conditions as mentioned below:

| Minimum Entry Age |

61 years |

| Maximum Entry Age |

Lifelong, no bar |

| Renewability |

Lifelong |

| Co-payment |

Member above 61 years or above pay 20% co-payment per claim |

| Pre-existing Disease Waiting Period |

36 months of continued coverage |

| Named Ailment Waiting Period |

24 months of continued coverage |

How to Choose the Best Health Insurance for Senior Citizens in India?

With the multiple options available in the market, choosing the best health insurance plan for senior citizens in 2025 can be tedious. Having said that, we’ve compiled a list of important things to consider while looking for a senior citizen mediclaim policy. Here you go:

- Study the Policy’s Coverage: A plan with maximum coverage and minimum exclusion is considered to be the ideal insurance for senior citizens. We offer the perfect health plans for senior citizens offering comprehensive coverage for pre and post-hospitalization, day-care treatments, annual health check-ups, second opinions, AYUSH treatments, and many more benefits.

- Check for High Sum Insured: If medical expenses are increasing, it is only logical that you need a higher sum insured that would lower your dependence on your savings. However, make sure that the best mediclaim policy for senior citizens offers an affordable premium while providing maximum coverage.

- Look for Easy Claim Settlement: While comparing health insurance plans for senior citizens helps, you would also know how different insurance companies settle insurance claims. This will get you closer to your goal of choosing the best insurer. Opting for an insurer with a high claim settlement ratio is a logical move.

- Check the Waiting Period: Go through the policy to understand the waiting period applicable for pre-existing illnesses and specified diseases. Almost all senior citizens' health insurance plans in India come with a waiting period, but you can find the perfect plan with a minimum waiting period.

- Pre-Medical Check-Ups: Some plans do not let you go through the time-consuming process of going through pre-medical check-ups. So, compare and select health insurance for senior citizens above 60 years without medical tests, where your elderly parents need not go through complex pre-medical health check-ups.

- Know Your Network Hospitals: With the cashless treatment facility, your elderly parents can stay relaxed that will have access to timely medical care when they need it. Check the network hospitals in your vicinity and pick a plan only after comparing the list of network hospitals.

- Convenience and Ease of Purchase: You or your elderly parents do not need to go anywhere and can buy a policy online with a few clicks. Read the features, benefits, coverage, claim process, and policy T & C on Care Insurance website or download the brochure to get every detail about the plan. With us, the process buying medical policy for senior citizen is quick and easy

- Verify Sub-limits: It is the limit placed by the insurance company on the health insurance claim. It is usually applicable to services such as room rent, ambulance charges, and certain medical procedures.

- No Claim Bonus: Ensure that you choose the best senior citizen mediclaim policy that offers an option to get up to a 150% increase in Sum Insured with the No Claim Bonus Super option. You don’t get any deduction on the premium rather, you get an increase in the sum insured. That’s the best for senior citizen.

- Check for Cashless Healthcare Providers: With the cashless health insurance facility, your elderly parents can stay relaxed that they will have access to timely medical care when they need it. We have 21600 cashless healthcare providers across the country to ensure you can access good health in your location.

By taking these factors into consideration, you can choose the appropriate medical insurance for senior citizens in India, to ensure peace of mind and comprehensive coverage for your loved ones.

Why Should You Compare Senior Citizen Health Plans Online?

Online comparison of health insurance for senior citizens India comes with multiple benefits. Here's how online comparison of senior citizen mediclaims covers helps you:

- Simplifies Policy Evaluation: At Care Health Insurance, we channel clear communication of all the policy terms across our website. While analyzing our medical plans for a senior citizen's medical treatment, you can find a precise description of covered expenses and benefits that makes the policy terms easier to understand.

- Makes Decision-making Convenient: Digital comparison helps you choose the best senior citizen health insurance from the comfort of your place. Also, at Care Insurance, we facilitate a digital premium calculator to help you estimate the approximate cost of older people's medical cover while customizing your plan basis on members and add-on benefits.

- Helps You Choose the Perfect Cover: Another benefit of comparing health plans online is the freedom to relook at the policy details anytime, anywhere. With absolute online transparency, Care Health insurance equips you with every policy detail from issuance to claim settlement, so that you can better select the right medical cover for your senior citizen parents.

- Cost-Effectiveness:By comparing health insurance for seniors online, you will be able to find the most competitively priced plan that suits your specific needs. Most of the details of the plan are laid out in an easy-to-read format, which ensures that you do not overpay for features that you do not need.

- Access to Review and Ratings:When you research health insurance for seniors online, you get easy access to reviews and ratings by customers. These reviews can help you gauge the level of customer satisfaction and the quality of the service offered by the company.

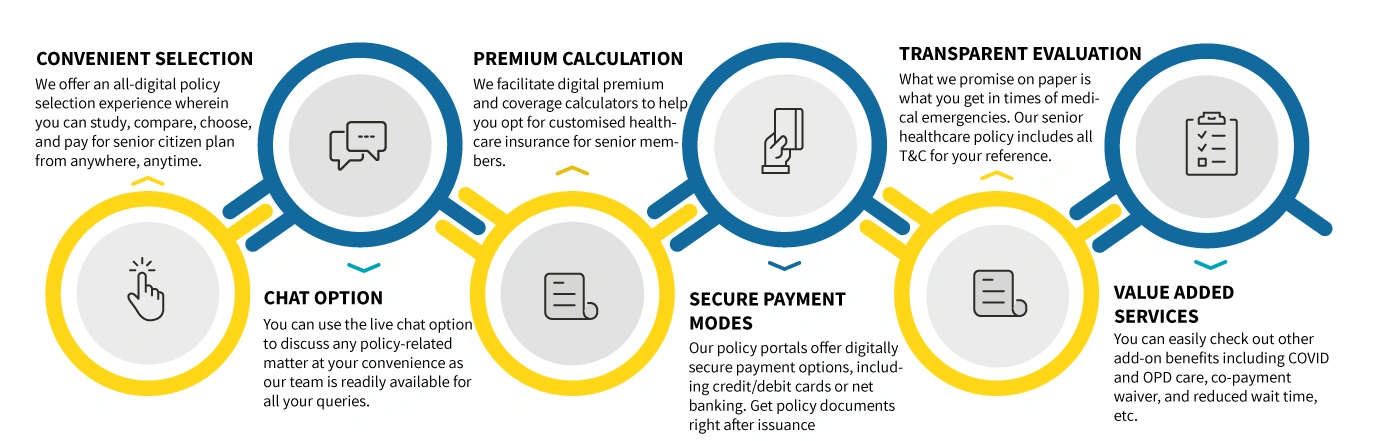

Why Select Senior Citizen Insurance Online with Us?

- Instant Access: We offer a fully digital experience that allows you to explore, compare, select, and buy the best senior citizen plan from anywhere and anytime.

- Chat Option: Discuss policy-related queries at your convenience. We are available for you 24*7.

- Premium Calculation: We facilitate digital premium and coverage calculators to help you opt for personalised health care insurance.

- Secure Payment Modes: We offer digital secure payment options, including credit/debit cards and net banking. You can get policy documents right after issuance.

- Transparent Evaluation: Clear and open communication about all aspects of the policy. Our senior citizen healthcare policy includes all T&Cs for your reference.

- Value Added Services: Easily check out other add-on benefits like reduction in PED wait period, No Claim Bonus Super, OPD Care & many more.

How to File a Claim Under Health Insurance Plan for Senior Citizens?

STEP 1

Emergency

Intimate within 24 hours of your hospitalization

Planned Hospitalization

Intimate us 48 hours prior to your hospitalization

STEP 2

Cashless

Request for pre-authorization

Reimbursement

Claim form submission

Complete the pre-authorization form available

at the hospitals' insurance/TPA Desk and send us through fax.

Approval

Approval letter sent by the claim management team

Query

Hospital/Insured to respond to the query raised by the claim management team

Rejected

You may initiate the treatment and file for reimbursement claim

Submission of claim form along with required

documents, as per the policy terms & conditions

Approval

Approval letter sent by the claim management team

Query

Insured to respond to the query raised by the claim management team

Rejected

We will communicate the reason in case of rejection

Documents Required to File a Claim for Senior Citizen Mediclaim Policy

The following original documents shall be submitted to initiate the claim settlement process-

- Completed claim form

- Original health insurance policy documents

- Pre-authorisation form (for cashless facility)

- ID proofs (Adhaar card and/or PAN card)

- Doctor’s prescription advising IPD admission.

- All bills related to pre-hospitalisation, hospitalisation and post-hospitalisation.

- Diagnosis certificate

- Surgeon’s certificate regarding detailed diagnosis, bills, receipts,

- Medical history, discharge certificate

- In the case of Domiciliary Hospitalisation, apart from the above-listed documents, a medical certificate stating the circumstances requiring Domiciliary hospitalisation

- Other documents required by the Company/TPA

Tax Benefits under Medical Insurance for Senior Citizens

Did you know that senior citizen insurance plans in India are not just meant to safeguard your finances but also help you save tax? Here's the good news! You can save up to ₹ 1,00,000.~ on tax with Care Health Insurance Senior Health plan.

Tax benefit under section 80D applies to all those with a health insurance plan. Insurers offering this plan can help you save up to Rs 100000 on your taxable income. The more you pay as taxes, the more you save. Depending on the amount of sum insured.

~ If the proposer and the insured member are above 60 years.

Myths About Senior Citizen Health Insurance Scheme

The quality of an elderly member's life improves after investing in a suitable health cover that shares the hospitalisation burden on time. So, here are five myths that you must be wary of while considering senior citizen mediclaim:

- Too Old to Get Covered: Elderly members aged 61 and above can get senior citizen medical coverage, so this myth is addressed well here.

- My Parents Suffer from illnesses, so They can’t Get Senior Citizen Health Insurance: Several seniors suffer from some sort of medical issue. This does not imply they are ineligible to buy a health insurance plan.

- OPD Visits are Not Covered: A Complete Myth! Under our senior citizen health insurance in India, you can enhance your senior citizen coverage with OPD care as an optional OPD benefit. It covers reimbursement of OPD bills ranging from Rs. 5,000 to Rs. 50,000 as per the policy terms.

- A Family Floater is Sufficient: While you can cover your parents under your existing family floater health insurance plan, sadly, it isn’t sufficient. As senior citizens are vulnerable to illnesses at their old age, sharing a single sum insured among members could be insufficient considering the rising medical inflation.

- Co-payment Charges Increase the Burden: With Care Health Insurance, senior citizens must pay only 20% of the medical claim as co-payment. However, we try to lessen this cost with the added benefit of a co-payment waiver.

By busting these myths, you can make a well-informed decision and select the most suitable policy.