Save tax up to ₹75,000~ u/s 80D

A critical illness insurance is a medical plan that covers the medical expenses up to a specified limit to insured members in case of hospitalisation due to critical illnesses such as cancer, catastrophic burns, or coma, as pre-defined under the chosen policy. This comprehensive and easy-to-acquire plan is available in family health and individual insurance options.

The insured individual might use the money to pay medical bills while treating a critical illness. In cases where an earning family member is diagnosed with a severe disease, the best critical illness insurance in India provides valuable financial support by covering the eligible medical expenses incurred during hospitalisation.

Individuals seeking protection against possible health emergencies can find a comprehensive shield with a critical insurance policy, especially with a medical history or pre-existing diseases. The benefits of critical illness policy coverage are extremely valuable for:

We at Care Insurance provide specialised critical illness benefits. Our easy-to-acquire individual and family health indemnity plan covers 32 critical illnesses pre-defined in the policy.

Our insurance plan for critical insurance policy contains the following significant features:

Critical Care Insurance offers substantial economic and emotional backing in case of a serious medical condition. Here are some of its key benefits:

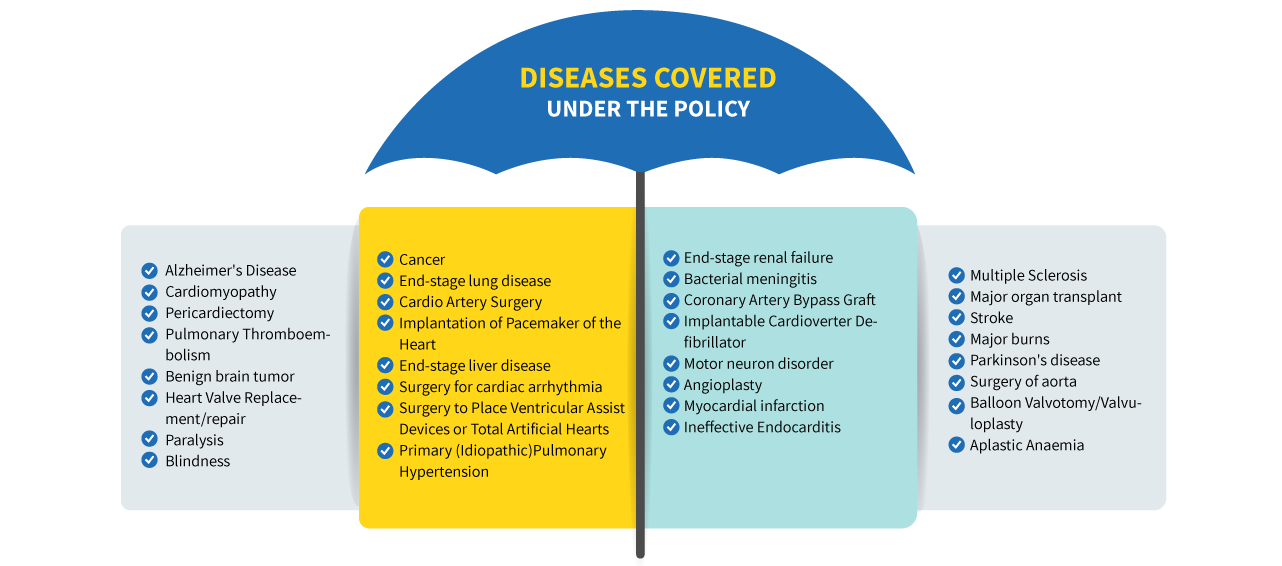

Critical Care insurance Plan provides coverage for 32 life-threatening medical conditions. Here are the list of the diseases covered in the plan:

Optional covers can be included in your policy to provide enhanced support during an emergency. Below are the optional covers you might not want to miss while buying yourself a critical illness cover policy:

Sometimes, policyholders are disappointed with their insurance plan because of misinformation about the coverage limits. Hence, it is advisable for policy buyers to carefully review their critical insurance policy’s exclusions to avoid such a situation in the future.

Claims deriving from the following are excluded:

Our plan offers comprehensive critical health insurance that helps policyholders combat essential diseases.

Understanding how critical illness they work can help ensure you are ready in case of a diagnosis.

Process from Buying to Claiming Critical Illness Insurance:

Like any other insurance policy, you must consider several factors when choosing the best critical illness insurance in India. You must also consider comparing different plans along with the following checklist:

| Entry Age- Minimum | Child: 91 days to 4 years with at least I member of age 18 years or above is covered or; 5 years on Individual basis Adult: 18 Years and above |

| Entry Age- Maximum | 50 years |

| Exit Age | No Exit Age |

| Age of Proposer (Adult) | 18 Years or above |

| Who are covered (Relationship with Respect to the Proposer) | Self, legally married spouse, son, daughter, father, mother, brother, sister, mother-in-law, father-in-law, grandmother, grandfather, grandson, granddaughter, uncle, aunt, nephew, niece, employee or any other relationship having an insurable interest. |

Critical Care insurance ensures a seamless claim process for its customers. Here are the steps to follow while filing a cashless claim or reimbursement for critical illness insurance.

| Cashless Claim Process | Reimbursement Claim Process |

|---|---|

| Step 1: Go to a listed in-network hospital. | Step 1: Submit your claim form along with other required documents. |

| Step 2: Fill out the required forms at the insurance desk. | Step 2: You'll get an approval letter when your claim is verified. |

| Step 3: Send the completed form to our claim management team. | Step 3: Respond to queries raised by the claim management team. |

| Step 4: You'll get an approval letter when your claim is verified. | Step 4: Get approval from the claim management team. |

|

Step 5: Respond to queries from the claim management team. You will receive communication about whether your cashless claim is approved or rejected. |

Step 5: Upon final approval, the reimbursement for eligible medical expenses is processed. You will be contacted if the claim is rejected. |

A critical illness diagnosis can be emotionally and financially devastating for an entire family. Care Insurance's critical illness cover acts as an essential financial safety net, protecting your family’s future when they need it most.

The best critical illness policy is advantageous in the following ways:

Critical illnesses need long-term treatment in most cases. A hurried lifestyle, in addition to inherited factors, might trigger the occurrence of such medical disorders. When buying a critical insurance policy, here are some points you need to keep in mind:

You do not need to go through the cumbersome formalities to buy critical insurance policy online from us. Our buying process is simple; you can follow the below steps to get your critical illness health insurance:

If you want to file a claim, contact us to make a claim registration. To file a claim, you'll usually need the following documents:

| Document Type | Description |

|---|---|

| Claim Form | The insurer gives a claim form to complete. |

| Medical Report | A report from the treating health expert detailing the diagnosis, treatment, and prognosis. |

| Diagnostic Test Reports | Test results, such as blood tests, scans, or biopsy reports, confirm the critical illness. |

| Discharge Summary | If hospitalisation occurs, the discharge summary from the hospital facility. |

| Policy Document | A copy of the critical illness insurance policy that includes coverage details and terms. |

| Identity Proof | A government-issued ID such as Aadhar card, passport, driver’s license). |

| Address Proof | Residential bills, utility bills, etc. documents |

| Medical History Documents | Medical history or reports related to the disease, if applicable. |

Critical illness health insurance premiums are deductible under Section 80D of the Income Tax Act 1961. Below are the tax benefits you can get on the premium you pay for the necessary illness policy according to age:

| Category | Eligibility | Tax Deduction Limit |

|---|---|---|

| Tax Deduction for Self, Spouse, and Children (Under 60) | For individuals under the age of 60 | Rs 25,000 per year |

| Tax Deduction for Self, Spouse, and Children (Above 60) | For individuals over the age of 60 | Rs 50,000 per year |

| Tax Deduction for Parents (Under 60) | For parents under the age of 60 | Rs 25,000 |

| Tax Deduction for Parents (Above 60) | For parents over the age of 60 | Rs 75,000 |

| Total Deduction for Family Premium (Under 60) | For individuals paying premiums for their family (under 60) | Up to Rs 75,000 |

| Total Deduction for Family Premium (Over 60) | For individuals over 60 paying premiums for their family | Up to Rs 1,00,000 |

Often, people get confused between a standard health insurance plan and a critical illness insurance policy. Not only that, but some of us believe that one of the two is sufficient in terms of health insurance.

Know how health insurance and critical illness insurance are vastly different from each other:

| Factors | Critical Illness Insurance | Health Insurance |

|---|---|---|

| Coverage | It covers hospitalisation due to life-threatening critical illnesses. | It covers standard hospitalisation conditions and treatment expenses. |

| Benefits | Pre-and post-hospitalisation, organ donor cover, dialysis cover, psychiatric counseling, etc. | In-patient hospitalisation, pre and post-hospitalisation, daycare treatments, ICU charges, and more. |

| A number of illnesses | 32 critical illnesses | Different types of chronic diseases, medical treatments, and procedures. |

| Waiting Period | 90 days initial waiting period (36 months for pre-existing diseases) | 30 days initial waiting period (36 months for pre-existing diseases). |

| Policy Period | Long-term Policy | Annual or Long-term Policy |

Cashless claim settlements are a cornerstone of the modern insurance landscape, offering numerous benefits to policyholders and the industry alike. Irdai in a master circular released on Wednesday alerted all insurance providers...

Read moreHealth insurance premiums are on their way up. A survey of 11,000 owners of personal health insurance policies by LocalCircles found that 52 per cent had witnessed an over 25 per cent increase in their renewal premiums in the past 12 months...

Read moreHealth Insurance for senior citizens: The recent amendments by the Insurance Regulatory and Development Authority of India (IRDAI) regarding health insurance rules are set to benefit senior citizens significantly...

Read moreAs we celebrate Mother’s Day, it is crucial to reflect on the health-related challenges that women face. From reproductive health to mental wellness, our mothers can encounter obstacles that demand attention, care and support...

Read moreCancer Coverage: Ever increasing number of cancer cases in India present a challenging aspect of the nation's healthcare landscape. According to the National Cancer Registry Programme, India recorded about 1.46 million new cases of cancer in 2022....

Read moreA growing number of health insurance customers are nowadays supplementing their base health insurance policies with riders. According to insurance aggregator Policybazaar.com, while only 15 per cent of customers purchased riders...

Read moreLook for hospitals around you

The critical illness health insurance covers the treatment expenses for any 32 acute illnesses, as listed in the policy document. The policy will be issued based on a tele-underwriter, and in a few cases insured may be asked to undergo a medical check-up.

This policy is an indemnity cover, and the insured can make multiple claims in a policy year. However, all claims made will be processed subject to the policy terms and conditions. The admissibility of any claim under the policy will be subject to the purview of coverage under the policy. Please refer to the policy T&C.

Like other health insurance policies, a critical illness insurance policy also offers tax benefits to the policyholders on the premium paid. As applicable, the policyholder is eligible for a tax deduction on the premium paid towards the policy under Section 80D of the Income Tax Act, 1961. These tax benefits are subject to changes in the tax laws in India.

When you buy critical illness insurance for your family or yourself, it is essential to consider various factors such as the medical condition, treatment costs, and the waiting period to complete before getting a claim for your expenses. Additional benefits such as organ donor cover and alternative treatment cover should also be considered when availing of a policy. Get a critical illness insurance quote online to ensure you have adequate coverage tailored to your financial profile.

Purchasing a critical illness insurance policy does not require you to pay a high premium. You can now get an affordable and the best critical illness policy in India with valuable benefits with Care Health Insurance which provides you with higher sum insured options with wide-ranging policy benefits.

No, this cover is not at all expensive. You can buy critical illness insurance online at an affordable premium with an EMI option.

The financial support from the health plan may not be sufficient to cope with the healthcare expenses of a critical illness, which can often necessitate long-term medical care.

The best critical illness policy in India is the one that will provide you with adequate financial support to combat a life-threatening disease so you can safeguard your savings and protect your family’s future.

Yes, it is important for senior citizens to have a critical illness plan as they have a greater risk of suffering critical illnesses. Further, most senior citizens have a limited source of income and savings, and a critical illness can severely hamper their finances.

Get the best financial security with Care Health Insurance!

Sales:1800-102-4499

Services:

8860402452

Live Chat

Super Mediclaim: UIN - RHIHLIP21374V022021

Disclaimer: The information above is just for reference. Kindly read T & C of the policy thoroughly. Do refer to IRDAI guidelines for tax exemption conditions.

~Tax benefit is subject to changes in tax laws. Standard T&C Apply

**Number of Claims Settled as of Dec'25

^10% discount is applicable for a 3-year policy

^^Number of Cashless Healthcare Providers as of Dec'25

*The premium is calculated for an insured individual (18) who opts for a sum insured of 10 lakh in a zone 3 city.