Subscribe to get weekly insights

Always stay up to date with our newest articles sent direct to your inbox

Published on 21 May, 2024

Updated on 15 Mar, 2025

1175 Views

4 min Read

Written by Rashmi Rai

1Like

Each year in India, crores of health insurance claims are raised and settled. As per reports, in the financial year 2022-2023, 2.36 crores1 of health insurance claims were settled by insurance companies with a total payment of ₹70,930 crores. To successfully raise a claim and get timely approval, it is quintessential to follow the correct claim procedure. One of the most essential steps is filling out the claim form.

Depending on the type of health insurance plan you have with usthe Care health claim form can also vary from plan to plan. Read on to learn more about the types of Care health claim forms and the associated procedures.

A claim form in health insurance is a formal piece of document that includes the details of the health insured, medical services taken by the insured, hospital details, etc. The claim form, like the Care insurance claim form, is an essential document that is needed to raise an official claim. Be it a reimbursement claim or a cashless claim, the claim form plays a vital role.

Now that you know what a claim form of Care Health Insurance is and how essential this document is, let's move further. Mostly, your healthcare provider will assist you at every step of the claim procedure. You can get assistance from our insurance executives to fill out the Care health claim form. At the same time, it is always a good idea to understand the process in detail so you can raise a claim quickly without any hassle.

Let's understand the process of filling Care health claim form in the steps given below:

To begin the procedure of claim filing, you need to get a claim form first. You can download the Care Health Insurance claim form pdf from the website. You may also contact us on the toll-free number 1800-102-4499 to connect with an executive for claim assistance. To download the claim form or Care Health Insurance claim form pdf, follow these steps:

Go to the homepage of the website of Care Health Insurance.

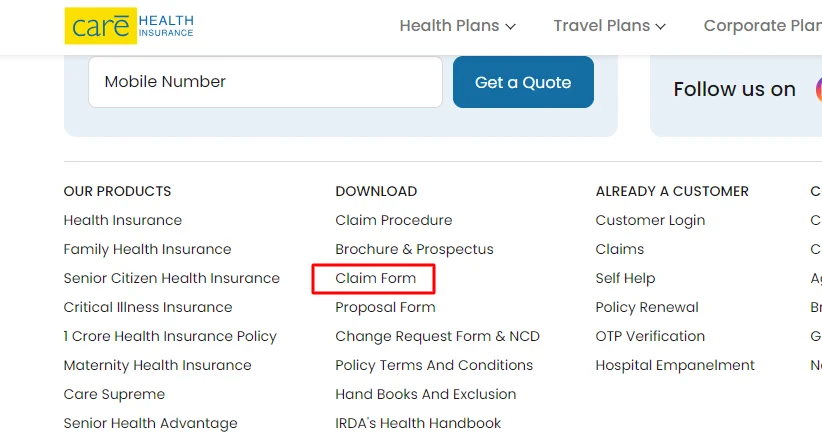

Scroll down on the page to reach the bottom. Here you can find the option of ‘Claim Forms’ under the “Download” Section. Click on it to proceed.

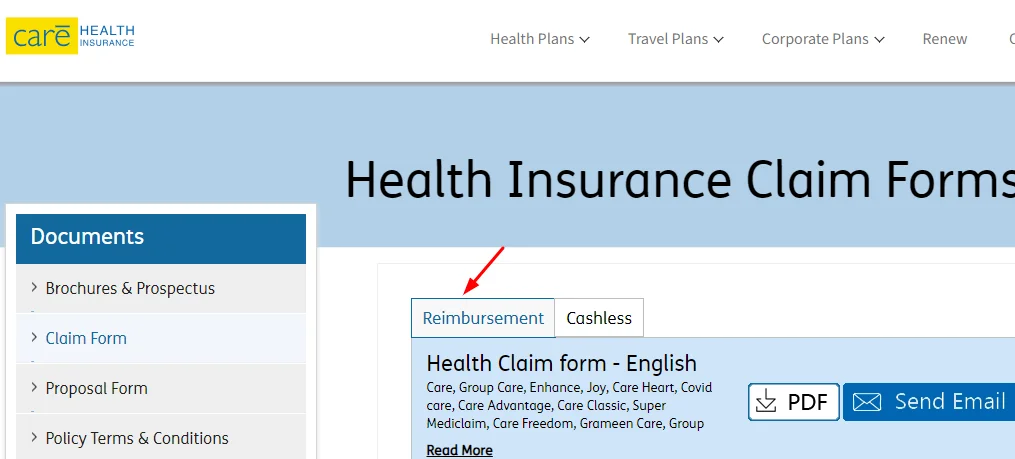

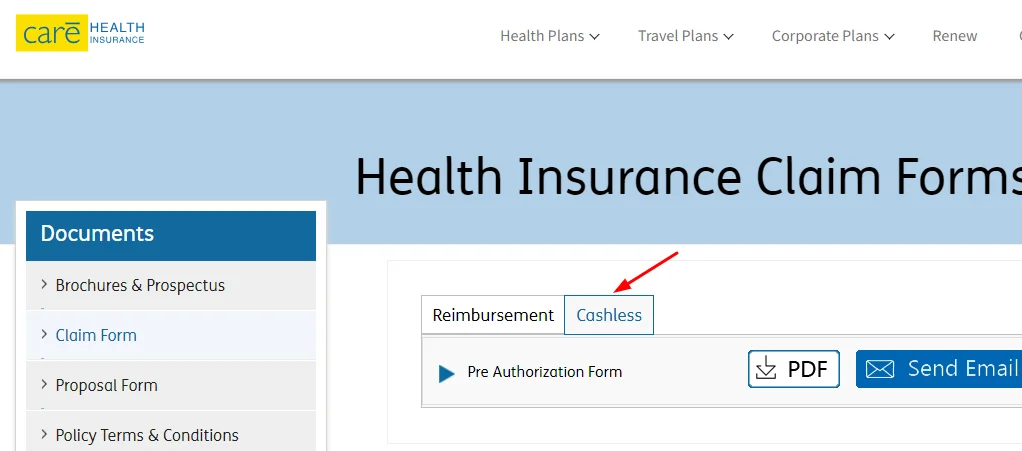

You can see a new table containing the Care health claim forms list. There are two types of options to choose from; reimbursement and cashless claims.

Reimbursement claims are filed when the insured receives medical treatment from a non-network hospital. In that case, all the medical bills along with the Care Health Insurance reimbursement claim form have to be submitted to the insurer post-discharge. Care Health Insurance reimbursement forms are broadly categorised into three parts; health, travel and others, as you can see in the image.

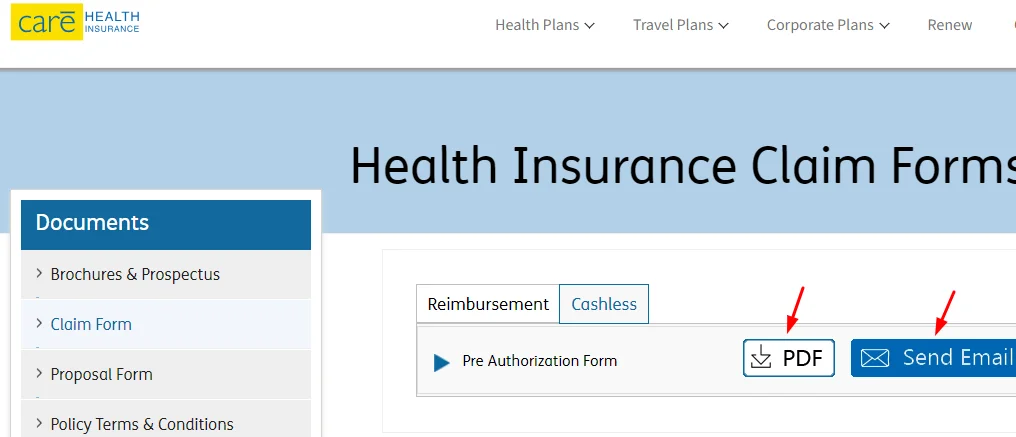

Another category is the cashless claim. For a cashless claim, you have to inform us and submit a pre-authorization form. You can download it from the website.

You may pick a Care Insurance reimbursement form or pre-authorization form for cashless benefit, as per your requirements. In case of any query, feel free to reach us.

In the next step, you can choose to either download the medical claim form pdf or receive it on your email.

Once you have the cashless or Care Health Insurance reimbursement claim form pdf, you can begin filling the claim form for Care Health Insurance.

The Care health claim form has two parts:

Part A of the claim form includes details of the health insured. Personal details like email, mobile phone number, address, identity proof, etc. have to be filled in this annexure. It has to be ideally filled by the person raising the claim.

Part B of the Care health claim form contains details of the hospital, the type of medical services required, etc. Typically, the hospital fills in the details in the Part B of the claim form.

>> Also Read: What is Claim Intimation? Know its Claim Procedures

Along with understanding the claim form downloading and filling process, you must also know about the types of health insurance claims. There are broadly two types of claims that are raised and settled; Indemnity and fixed payout claims. Let's take a look at them both:

Indemnity claims are the ones where the health insurance company pays for the actual medical treatment expenses (within the sum insured limit) incurred by the health insured. There are two types of indemnity claims:

Cashless claims are raised at a network/empanelled hospital of the health insurance company. Care has 21600 network healthcare providers across the country. So, finding one in your vicinity is usually easy. For such types of claims, you need to submit a pre-authorization claim, as discussed above.

Care Health will verify and approve the claim and thereafter, all the admissible medical expenses will be directly settled with the hospital. So, the insured is free from the burden of (admissible) medical payments.

As the name suggests, in reimbursement claims, the insurance company reimburses all the admissible medical bills after the discharge of the insured. In this case, the insured first pays the bills upfront and then they need to raise a claim with a Care Health Insurance reimbursement claim form. After approval of the claim, the amount is disbursed to the registered bank account.

Fixed payout claims are health insurance claims where the insured pays a lump-sum amount upon diagnosis of the listed disease. Hence, the claim has nothing to do with the actual expense of the medical treatment but pays the lump-sum amount so the insured can utilise it in their preferred way. Usually, critical illness plans have fixed payouts.

Note: All our health insurance plans are offered as indemnity cover where claims are settled as cashless or reimbursement basis.

A claim form like a Care health claim form is an essential document that acts as the face of your claim. It has all the necessary details of the patient/ insured and the hospital. So, the details must be filled in correctly to avoid any delay or rejection of the claim. Make sure to check the claim form details carefully before submitting. You may download the medical claim form pdf to understand the process better. In case you find it difficult to understand the claim process or fill out the claim form, you can contact us at the toll-free number 1800-102-4499 or contact us by clicking here. You can choose any of the preferred methods to get your query resolved.

Disclaimers: The above information is for reference purposes only: Policy Assurance and Claims at the underwriter's discretion.

How to Download Care Health Insurance Policy? Care Health Insurance in Health

How to Check the Status of Your Health Insurance Policy? Care Health Insurance in Health

What is the Use of ABHA Health Card? Care Health Insurance in Health

Do Health Insurance Premiums Increase Every Year? Care Health Insurance in Health

Why Group Medical Insurance is Important for Employees? Care Health Insurance in Health

Understanding Telemedicine Health Insurance- A Comprehensive Guide Care Health Insurance in Health

What are Teleconsultation and TeleHealth Insurance? Care Health Insurance in Health

How Can Advancements in Technology Impact The Future of Health Insurance? Care Health Insurance in Health