Subscribe to get weekly insights

Always stay up to date with our newest articles sent direct to your inbox

Published on 13 Aug, 2024

Updated on 13 Aug, 2024

611 Views

5 min Read

Written by Rashmi Rai

favorite0Like

favoriteBe the First to Like

What do you understand by the phrase- major life changes? What do you feel is implied by a life change in health insurance?

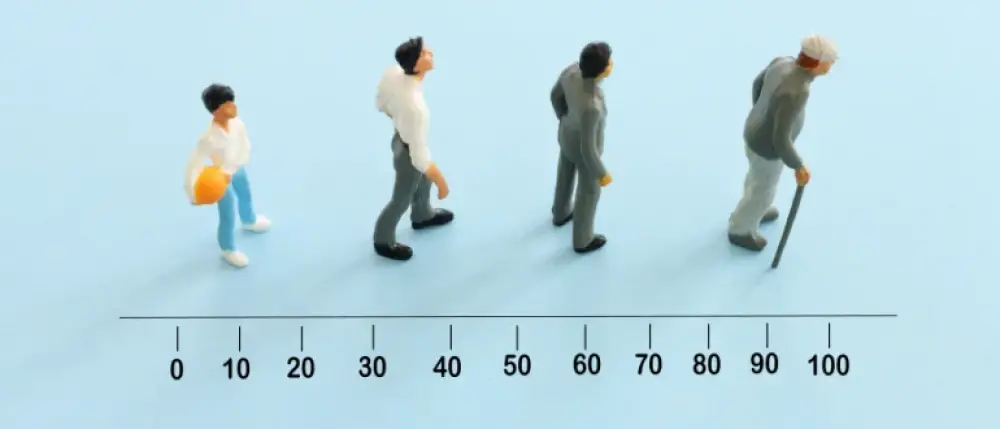

Life changes are transitions in life that may be challenging to navigate as these take you into the unknown. While negative changes are always difficult for you to deal with, even changes for the positive may be difficult to cope with and may be stressful. This stress arises from the fact that these life changes can disturb the present status quo or threaten your sense of security.

Life change in health insurance refers to qualifying life events. Normally you renew your health insurance policy for a period of 1 year. No changes in the coverage or any terms of the policy are allowed within this period. However, qualifying life events make you eligible for navigating health insurance by signing up for increased coverage in the form of the sum insured or to update your current plan otherwise.

Life change in health insurance may be classified into three categories:

1. Change in health insurance coverage in case of

2. Changes in the household can lead to changes in health insurance including

3. Changes in residence need to be updated in the health insurance plan. It could lead to a change in premium as well.

Let’s elaborate these life-changing events which could lead to a change in Health Insurance.

Most private companies and multi-national corporations in India regardless of the sector they are in provide their employees with health insurance under group insurance schemes. The coverage under such schemes extends to your dependant family, and in some companies, you are also able to buy health insurance coverage for your parents as well at subsidised premium rates.

You lose this employer-provided health cover in the unfortunate eventuality of losing your job. The cover ceases with your last working day. In case your employer had allowed you to increase your sum insured by paying for it additionally, only such coverage remains till the end of the financial year or policy term, whichever comes first.

You will face a similar situation with the coverage from health insurance during job change too.

Pro Tip: You can avoid such uncertainty by investing in a health insurance policy yourself, which will run concurrently with your employer-provided health insurance. The coverage offered by such a policy acts as a financial safety net you have in place for your family’s well-being. It is recommended to go for a family floater plan with proper add-on riders as required by you and your family.

In India, your dependent children are covered by your health insurance policy till the age of 25. As soon as they turn 26, they lose the cover.

Pro Tip: Invest in a comprehensive health insurance policy with an appropriate sum insured for your child as early as possible. There are numerous benefits to investing in a health insurance policy from an early age; getting policy at a competitive rate being one of the reasons.

These happy events are accompanied by a huge increase in your responsibilities, especially in the latter two instances. In case of marriage, your spouse may have existing health insurance coverage. In case of a change in surname, you would need to inform the health insurance company and get the change endorsed in the policy. To add your newborn or adopted child to your existing family floater health plan, you would need to inform your health insurance company.

You can invest in a health insurance plan for your newborn or adoptee child only after the child is of 90 days age with almost all insurers.

Pro Tip: An addition to your family in the form of marriage, birth or adoption is a good opportunity to analyse your health insurance and choose your sum insured accordingly.

In case you are covered by your employer-provided group medical health insurance scheme, please inform your employer immediately in order to add your new dependents to the medical coverage as per your entitlement.

In case of divorce, you may cancel the coverage for your ex-spouse who is no longer dependent on you. Remember that your ex-spouse too may cancel your coverage in his or her own policy. This is applicable to all employer-provided health insurance schemes too. You need to arrange for coverage for yourself at the earliest. In case of the death of any policyholder or dependent, their name needs to be removed from the existing policy.

Pro Tip: Inform your health insurance company of the changes and get it endorsed on your existing policy to make the changes official.

>> Also Read: Buying Health Insurance at 20, 30, Or 40: Here’s What You Need to Know

Life change in health insurance includes you changing your city, town or village of residence.

In India, a few health insurance companies follow a system of zone-based premium calculation. The premium in Zone 1 is the highest and lowest in Zone 3. This follows a price computation method and the logic is charging higher premiums for geographies with higher medical costs and vice versa. You will agree that the price of health care in Mumbai or Delhi is far higher than the cost of health care in Guwahati or Raipur. The classification of zones is left to the particular insurance company. Such health insurance companies have a co-pay clause in case you have a policy from a lower zone and choose to get treatment at a higher zone centre. Typically, a co-pay of 20 per cent is applicable if you have a policy issued in Zone 3 and are availing of healthcare in a Zone 1 centre.

In case your health insurance company does offer and follow a premium structure by zone as opposed to uniform premiums with pan-India coverage, you would need to inform them if you change your residence. In the instance of you shifting your residence from a tier 1 to a tier 3 city, you may be entitled to a partial refund of your premium depending on policy terms and conditions.

Care Health Insurance offers a zone-based health insurance plan called Care Classic where they categorised the cities into:

Premiums for the same plan may vary based on the zones. Hence, it is important to inform your health insurance company about changes in your residence immediately and get the same endorsed in your policy and get a partial refund, if applicable.

As you see major life changes, both planned and unplanned, are directly linked to your health insurance decisions. Yet when you are beset by any such event, first document it, meticulously go over all the options available to you, carefully weighing your considerations and then implement your choices wisely. Do not procrastinate at any cost as a life change in health insurance is an extremely vital cog in your financial planning and long-term goals.

Disclaimers: All plan features, benefits, coverage, and claims underwriting are subject to policy terms and conditions. Kindly refer to the brochure, sales prospectus, and policy documents carefully.

favoriteBe the First to Like

Thyroid : मामूली नहीं हैं महिलाओं में थायराइड होना, जानें इसके लक्षण और घरेलू उपचार Vipul Tiwary in Diseases

शुगर कंट्रोल कैसे करे? जानें, डायबिटीज में क्या खाना चाहिए Vipul Tiwary in Health & Wellness

हाई ब्लड प्रेशर को तुरंत कंट्रोल कैसे करें? देखें इसके उपाय Vipul Tiwary in Diseases

पैरों में दर्द किस कमी से होता है? जानें, इसके घरेलू इलाज Vipul Tiwary in Health Insurance Articles

Smog Season is Back: Are You Really Safe? Sejal Singhania in Health Insurance Articles

Amino Acids: The Unsung Heroes of Your Mental Well-being Jagriti Chakraborty in Mental Health

8 Reasons to Start Your Morning with Ajwain Water Jagriti Chakraborty in Home Remedies

Ice Water Face Dip: The 15-Second Beauty Hacks Celebs Swear By Jagriti Chakraborty in Home Remedies

Always stay up to date with our newest articles sent direct to your inbox

Loading...