Save tax up to ₹75,000~ u/s 80D

Save tax up to ₹75,000~ u/s 80D

Do you know that you can get dual protection for your savings with a comprehensive health insurance plan? First, it covers the medical expenses you incur in a year, saving you from the financial stress when coping with an illness or injury. Secondly, you get a chance to save tax! The premium you pay towards a mediclaim or health insurance policy qualifies for tax deduction under Section 80D of the Income Tax Act 1961. That is, it reduces your tax liability. Therefore, health insurance is vital to grow your savings and ensure financial stability.

Let us understand section 80D benefits and how you can enjoy tax benefits with health insurance plans.

Section 80D is a provision under the Income Tax Act of India that allows a person, an individual, or HUF (Hindu Undivided Family), to claim income tax deductions from the taxable income to pay the health insurance premium. The premium paid for a health insurance policy for self, dependent parents, spouse, and children is exempt from tax. Under this section, health insurance premium, contributions to the Central Government Health Scheme, and preventive health check-ups qualify for a tax deduction under section 80d.

However, the amount of medical insurance tax rebate on health insurance for individual and family depends on the insured's age and income. Opt for health insurance as it enables you to save money considerably under section 80D.

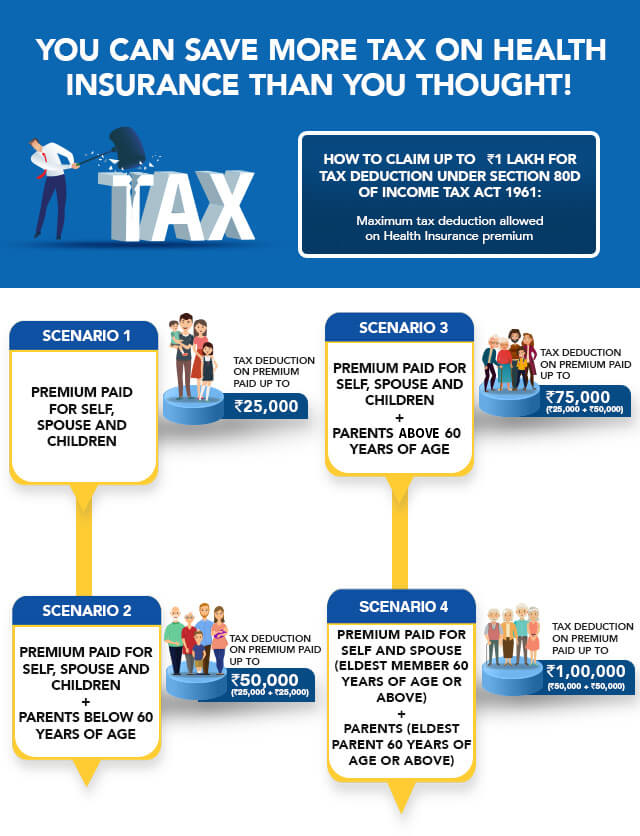

The deduction for mediclaim under 80D of the Income Tax Act may vary according to the nature of your policy. Below is the table that helps you to understand it better:

| Persons Covered | Exemption Limit | Total |

| Self and family | Rs 25,000 | Rs 25,000 |

| Self and family + parents | Rs 25,000 + Rs 25,000 | Rs 50,000 |

| Self and family + senior citizen parents | Rs 25,000 + Rs 50,000 | Rs 75,000 |

| Self (senior citizen) and family + senior citizen parents | Rs 50,000 + Rs 50,000 | Rs 1,00,000 |

Please Note: The New Tax Regime of FY 2023-24 does not offer tax deductions toward health insurance under section 80D of the IT Act.

Check now Mediclaim Policy for Parents

Read here how you can avail of medical insurance tax benefits under a health insurance policy:

Health insurance premium refers to the sum of money you have to pay to the insurance company to get the coverage under a mediclaim policy. Section 80D of the Income Tax Act allows you to get a tax deduction of up to Rs 25,000 per year for any individual and family health insurance policy covering self, spouse, and children. Senior citizens can get a deduction up to a maximum of Rs 50,000 per year.

Example:

Rohit (aged 40 years) opted for a health insurance plan covering himself, his wife (36 years), and 8-year old child. He pays an annual premium of Rs 25,850. He also pays a health insurance premium of Rs 45,000 for the mediclaim policy covering his elderly father (67 years) and mother (62 years).

In this way, he becomes eligible for the total deduction under Section 80D up to Rs.70,000 for a year.

Preventive health check-up expenses up to Rs. 5,000 are eligible for Section 80D tax exemption. For instance, Ram has paid Rs. 23,000 as the premium for his mediclaim and also spent Rs. 5,000 for his health check-ups. As per the policy, he is eligible for tax exemptions of Rs. 23,000 for the premium paid and Rs.2,000 for a health check-up; the total is Rs. 25,000. It is so because, under section 80D of the Income Tax Act, the maximum claim cannot exceed Rs. 25,000.

Filing a tax return will not be a daunting task if you follow simple steps that can ease the process:

A sound health insurance policy provides you and your family a comprehensive medical coverage and supports you in your tough time. It bears your medical expenses and helps you access the best possible treatment. Its benefits are not limited to this; along with the proper treatment and financial security, it entitles you to get mediclaim tax benefits and deduction under 80D of the Income Tax Act. That is why investing in the right health insurance offers you a double bonanza.

Read about Income Tax Slabs and Deductions | Income Tax Slabs for Women | Income Tax for Senior Citizens

Health Insurance is a shield that protects you and your loved ones in cases of medical emergencies.

An affordable health insurance plan makes sure that financial crisis is not an issue during a medical emergency.

With the skyrocketing cost of healthcare in the country, opting for a good health Insurance Plan is a smart decision for the safety of the individual and family as a whole.

21600

Cashless Network Providers^^

48 Lakh+

Claim Settled**

100%

In-house settlement for better management

7 Crore+

Lives Covered Since Inception

24 X 7

Claim Support

The following steps can help maximise medical insurance tax benefits for your family:

Example:

The health insurance policy covers employees, including spouses and children. The existing health insurance policy insured up to Rs 10 lakh.

Maximum tax deduction limit: Rs 25,000

The health insurance premium paid: Rs 15,280

The unutilised Section 80D Limit: Rs.9720

To maximise Section 80D benefits, the person can go for a cashless *OPD offering of Rs 15,000 at a premium of Rs 11,000 (with GST), thus saving Rs 4000. Besides getting the cashless facility and enhanced coverage, the person also saves Rs 2,916 as medical insurance tax exemption.

Suppose a person opts for a mediclaim policy with a validity of more than one year and pays the premium as a lump sum. In that case, the mediclaim deduction is calculated by dividing the total premium amount paid by the number of policy years. You are eligible to save tax up to Rs 1,00,000 depending upon the number of insured members and their ages.

#Apart from the tax exemption under 80D on the health insurance premium, you are also eligible for an additional deduction under Section 80D up to Rs 5,000 on preventive health check-up expenses incurred for your family members.

When you have financial responsibilities towards your family, opting for health insurance serves the dual purpose of securing your finances against rising medical bills and reducing the tax burden. The income tax act has various provisions that make you eligible for tax benefits under the different sections, including deductions under Section 80D. Opt for Care- a comprehensive health insurance policy offered by Care Health Insurance gives you maximum coverage and health insurance tax benefits.

Look for hospitals around you

A tax deduction is availed on individual health insurance or family plans. Premium paid towards health insurance taken for self, spouse, children and parents is allowed for deduction. To claim the deduction, ensure all medical expenses are paid in valid payment modes like net banking and digital platforms except cash.

Every individual and HUF can claim an 80D deduction.

The income tax department doesn’t ask for any document/receipt to claim the deduction. However, for a record and proof, it is recommended to keep the receipt of the payment with a policy document mentioning the name of the policyholder.

An individual paying the premium towards a health insurance policy is eligible for a maximum medical insurance tax exemption up to Rs 1,00,000 per year if the proposer and the insured are above 60 years of age.

No. Policyholders are not eligible for a tax deduction under Section 80D if they have made a cash payment for the health insurance premium. To avail of the medical insurance tax benefit, opting for a payment mode other than cash, such as net banking or credit/debit card is necessary.

Parents cannot get Section 80D benefit if the health insurance premium is paid on behalf of working children.

As applicable, one can get a tax deduction on the premium paid for more than one health insurance policy, subject to the maximum tax deduction limit.

~Note: Tax deduction on health insurance premium is subject to rules and regulations of the Income Tax Act. Please refer to them before filing the return.

*As per underwriter discretion

^^Number of Cashless Healthcare Providers as of Feb 2025

**Number of Claims Settled as of 31st March 2024

^10% discount is applicable for a 3-year policy

#Premium calculated for an individual (Age 18) for sum insured 5 Lakhs in Zone 2 cities.

Get the best financial security with Care Health Insurance!

Sales:1800-102-4499

Services: 8860402452

Live Chat